COVID Impact V: Bonus for German Real Estate Market?

The German government managed the corona crisis well in phase 1 and is now stabilising the economy in phase 2 with a 130 billion euro fiscal stimulus program. This creates security not least for internationally active real estate investors, who currently find better conditions in Germany than in France or Great Britain, for example.

I discussed the specific potentials of the German real estate market with leading investment managers and the renowned economist Professor Marcel Fratzscher in a Heuer #digitaltalk webinar on 16 June. Here you will find the main results.

Stable investment conditions in Germany

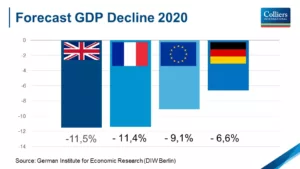

The German Institute for Economic Research expects the German economy to shrink by around 6.6 percent in 2020 assuming there will be no second corona wave in autumn. This is a significant minus, which is, however, well compensated by state guarantees and the largest fiscal stimulus program the country has ever seen.

Comparison with France and United Kingdom

France, for example, is forecast to lose 11.4 percent of its economic power, and the UK is even expected to experience a decline of 11.5 percent. The German market is remarkably robust, especially in comparison to these two large economies, which usually also attract a large proportion of real estate transactions each year.

Long-term cash flow

As a result of this comparatively high level of stability, we at Colliers expect average and prime rents in Germany to remain at solidly high level. Investors therefore still have a reasonable prospect of a secure long-term cash flow.

Well diversified rental markets

On the letting markets in Stuttgart and Munich, for example, we are currently receiving a number of large-scale enquiries that illustrate how diverse the tenant structures are in both cities. The old cliché that the German economy is primarily dependent on the automotive industry is once again refuted by these inquiries. Also in Hamburg, Frankfurt and Dusseldorf, for example, we currently see good opportunities to find value.

Exploiting the breadth of German real estate market

International investors have long been focused on Berlin. Its status as the German capital will continue to ensure the continuous development of the city. At the same time, it may be worthwhile for investors to take a closer look at other prime cities in Germany too. Our regional teams will be happy to help you identify the best opportunities.